Royal Bank of Canada said today its wealth management unit logged net income of C$597 million in the first quarter of 2018, up 39 per cent from this time last year.

The C$167 million jump over the past year was propelled by higher average fee-based assets, inflated net interest income from volume growth and higher rates, Canada’s largest lender by assets said, as well as a lower effective tax rate on the back of US tax reforms. Since the previous quarter, net income was up C$106 million, or 22 per cent.

“Strong client activity and volume growth across most businesses drove our first quarter earnings of C$3 billion while we absorbed the write-down related to the US tax reform,” Dave McKay, RBC president and chief executive, said. “We invested in our businesses to support clients, and repurchased over C$920 million of common shares. In addition, I am pleased to announce a 3 per cent increase to our quarterly dividend. Our strategy for sustainable growth is built on prudently managing risks and effectively deploying capital for strong returns through the cycle.”

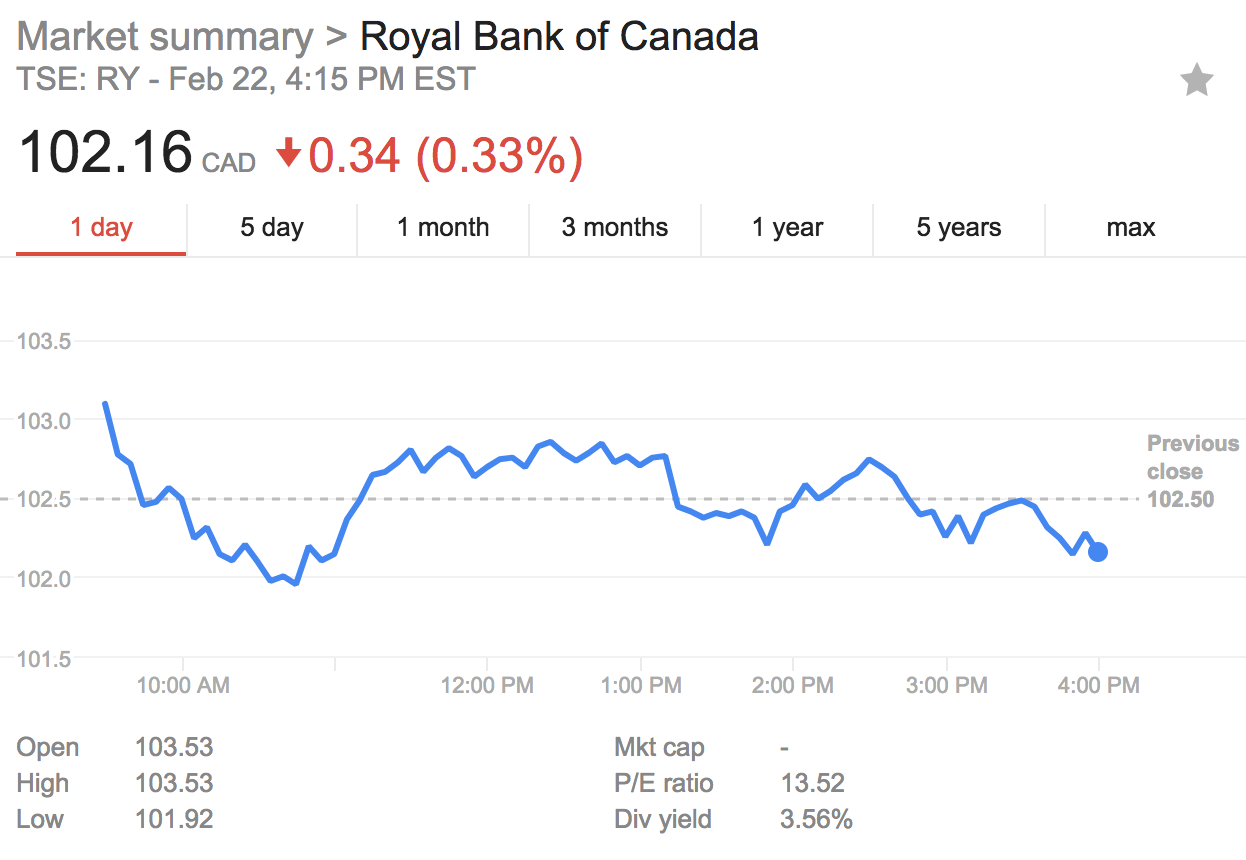

The bank's share price had slipped 0.33 per cent at the time of writing , trading at $102.16.

Source: Google

Assets under management across all of the bank’s wealth management businesses, including City National which it acquired in 2015, stood at C$651 billion, up 17 per cent year-on-year. Assets under administration came in at C$938.8 billion, up from C$852.6 billion a year prior.

Royal Bank of Canada Wealth Management now employs some 17,092 staff worldwide, it said, having added 1,154 employees over the past year.

Meanwhile, Royal Bank of Canada net income remained relatively flat year-on-year at C$3 billion. This figure, however, took into account a $178 million write-down related to tax restructure in the US. Dividends rose 3 per cent, of C$0.03, to $0.94 cents per share. Return on equity was 17.4 per cent, down 60 basis points year-on-year.